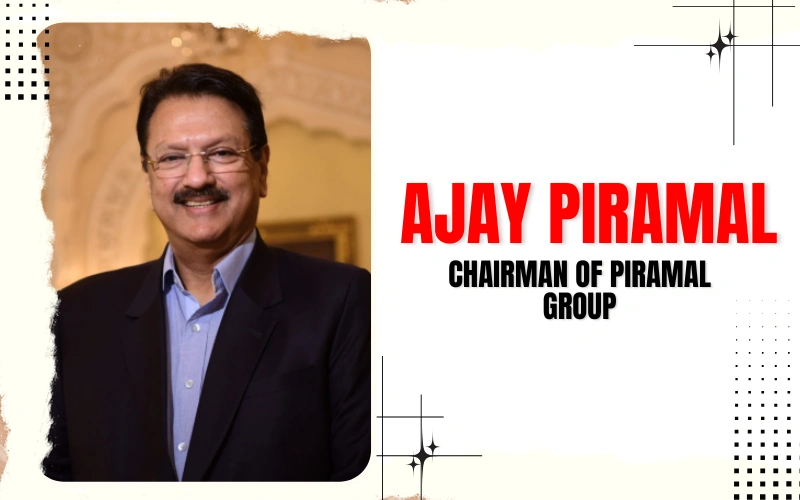

Ajay Piramal is an Indian billionaire businessman, philanthropist, and chairman of the Piramal Group—a conglomerate with interests in healthcare, financial services, and real estate.

Quick Facts About Ajay Piramal

| Full Name | Ajay Piramal |

| Age | 69 years (as of 2025) |

| Date of Birth | January 3, 1955 |

| Net Worth (2025) | ₹40,000+ crores (~$4.8 billion) |

| Education | MBA from Jamnalal Bajaj Institute |

| Wife | Swati Piramal |

| Children | Nandini Piramal (daughter), Anand Piramal (son) |

| Company | Piramal Group |

The Early Days: When Textiles Taught Tough Lessons

Born into the Piramal family in 1955, Ajay Piramal grew up watching his father, Gopikisan Piramal, navigate the choppy waters of the textile industry. But young Ajay wasn’t content with just observing—he was absorbing, learning, and preparing for his own entrepreneurial journey.

After completing his Bachelor’s in Science from Bombay University, he pursued a Master’s in Management Studies from the prestigious Jamnalal Bajaj Institute. Armed with education and ambition, he joined the family business in 1978, ready to make his mark. The company’s value? A modest $50 million. His vision? Unlimited.

But here’s where the plot thickens. The Indian textile industry in the 1980s was like a sinking ship. Liberalization was still a distant dream, competition was fierce, and profit margins were thinner than tissue paper. Most business heirs would have either stubbornly stuck to the family trade or sold off and called it a day. Ajay Piramal did neither. Instead, he did something audacious—he decided to jump ship and build a new vessel altogether.

The Pivot That Changed Everything: Hello, Pharma!

In 1988, Ajay Piramal made a decision that would define his legacy. He diversified into pharmaceuticals by acquiring Nicholas Laboratories. This wasn’t just a business move; it was a calculated gamble based on deep market analysis and foresight.

Why pharmaceuticals? Simple. He saw an industry with enormous growth potential, relatively low competition in the branded generics space, and a market that would only expand as India’s population grew and healthcare awareness increased. While others were still obsessing over textiles and traditional industries, Piramal was already three steps ahead.

The acquisition wasn’t smooth sailing, though. Integrating a new company, understanding pharmaceutical regulations, and building a distribution network from scratch—these were Himalayan challenges. But Piramal approached them with methodical precision, leveraging his management education and innate business instincts.

Building the Pharmaceutical Empire: One Smart Acquisition at a Time

Here’s where Ajay Piramal truly showcased his strategic genius. Instead of trying to build everything from scratch, he adopted an aggressive acquisition strategy. Between 1988 and 2010, the Piramal Group acquired over 30 pharmaceutical brands and companies, including heavyweights like Roche’s India business, ICI’s healthcare division, and Aventis’s portfolio.

Each acquisition wasn’t just about adding numbers to the balance sheet. Piramal had a clear strategy:

- Acquire brands with strong market presence

- Integrate them efficiently to extract maximum synergies

- Focus on high-margin therapeutic segments

- Build a robust distribution network

By the early 2000s, Piramal Healthcare had become one of India’s leading pharmaceutical companies, with a presence in over 100 countries. The company’s flagship brands like Tetmosol, Polybion, and i-Pill became household names.

The $3.72 Billion Masterstroke: Selling to Abbott

Now, let’s talk about the deal that made everyone’s jaw drop. In 2010, Ajay Piramal sold his domestic formulations business to Abbott Laboratories for a whopping $3.72 billion. At that time, it was one of the largest M&A deals in the Indian pharmaceutical sector.

Critics called him crazy. Supporters called him a genius. Turns out, the supporters were right.

Why did he sell? Because Piramal saw that the domestic formulations business was becoming increasingly competitive with shrinking margins. The real value creation was shifting to contract research, manufacturing, and critical care. So he cashed out at the peak, retained the high-growth segments, and used the proceeds to diversify further.

This move showcased three things:

- His ability to time the market perfectly

- His willingness to let go of successful businesses if better opportunities existed

- His long-term strategic thinking over short-term sentimentality

The Family Affair: Building a Dynasty

Ajay Piramal’s success story wouldn’t be complete without mentioning his family’s role. His wife, Swati Piramal, is herself a formidable business leader, serving as Executive Director of Piramal Enterprises. She’s been instrumental in driving the group’s healthcare innovations and social initiatives.

Their daughter, Nandini Piramal, serves as Executive Director of Piramal Enterprises, while their son, Anand Piramal, heads Piramal Realty and is married to Isha Ambani (yes, THAT Ambani—daughter of Mukesh Ambani). Talk about power families!

But here’s what’s impressive: despite being a family-run business, the Piramal Group has maintained professional governance standards, brought in external management talent, and avoided the typical pitfalls of family businesses in India.

The Philosophy: What Makes Ajay Piramal Different?

So what’s the secret sauce? What makes Ajay Piramal stand out in a sea of Indian industrialists?

1. Contrarian Thinking

When everyone zigs, Piramal zags. He exited textiles when it was still considered respectable, entered pharma when it was fragmented, and sold his crown jewel when everyone thought he was building a legacy business.

2. Patient Capital Approach

Unlike many modern entrepreneurs who want unicorn status overnight, Piramal takes a long-term view. He’s willing to invest heavily, wait patiently, and scale sustainably.

3. Value-Based Leadership

The Piramal Group is known for its ethical business practices, commitment to sustainability, and focus on creating value for all stakeholders—not just shareholders.

4. Continuous Learning

Even at 70, Ajay Piramal is known for his voracious reading habits and curiosity about emerging trends. He doesn’t rest on past laurels but constantly updates his mental models.

5. Strategic Partnerships

From partnering with Warburg Pincus for financial services to collaborating with global pharma giants for drug development, Piramal understands the power of strategic alliances.

The Challenges: It Hasn’t All Been Smooth Sailing

Let’s keep it real—Ajay Piramal has faced his share of setbacks. The 2008 financial crisis hit the pharma business hard. The real estate slowdown impacted Piramal Realty. Regulatory challenges in financial services created headwinds.

In 2020, when DHFL (a non-banking financial company that Piramal acquired) faced severe stress, many questioned whether he had bitten off more than he could chew. The resolution process was complex, lengthy, and fraught with challenges.

But here’s what separates good entrepreneurs from great ones: resilience. Ajay Piramal didn’t panic during crises. He restructured, refinanced, and reimagined his approach. He took losses where necessary and doubled down where he saw opportunity.

The Social Side: Beyond Business

What truly elevates Ajay Piramal from successful businessman to respected leader is his commitment to social causes. The Piramal Foundation works on healthcare, education, and community development initiatives, impacting millions of lives across India.

The foundation’s initiatives include:

- Setting up healthcare centers in underserved areas

- Education programs for underprivileged children

- Women’s empowerment initiatives

- Disaster relief efforts

The Future: What’s Next for the Piramal Empire?

As Ajay Piramal enters his eighth decade, retirement seems to be the last thing on his mind. The Piramal Group continues to expand aggressively, with major focus areas including:

- Digital Health: Leveraging technology to make healthcare more accessible

- Green Finance: Funding sustainable and eco-friendly projects

- Pharma Innovation: Investing heavily in R&D for next-generation drugs

- Global Expansion: Strengthening presence in international markets

Lessons for Aspiring Entrepreneurs

What can we learn from Ajay Piramal’s incredible journey? Here are the golden nuggets:

1. Industry Trends Matter More Than Industry Loyalty Don’t fall in love with your industry; fall in love with creating value. If your sector is dying, have the courage to move.

2. Timing Isn’t Everything, But It’s A Lot Piramal’s ability to enter and exit businesses at optimal times has been crucial to his success. Study market cycles obsessively.

3. Diversification Done Right Is Powerful But diversification done wrong is disastrous. Piramal only diversifies into sectors he deeply understands or where he can bring in expert management.

4. Cash Is King The Abbott sale gave Piramal the financial muscle to weather storms and pursue opportunities aggressively. Always maintain a strong balance sheet.

5. Build Systems, Not Just Businesses Piramal’s companies are known for strong governance, professional management, and scalable systems. This allows him to operate across multiple sectors simultaneously.

6. Ethics Aren’t Optional In a business environment often criticized for cutting corners, Piramal has maintained ethical standards. This builds trust, attracts talent, and ensures long-term sustainability.

Conclusion: The Piramal Playbook

Ajay Piramal’s story is more than just a rags-to-riches tale (though it kind of is). It’s a masterclass in strategic thinking, calculated risk-taking, and relentless execution. From transforming a $50 million textile company into a $4+ billion diversified conglomerate, Piramal has consistently demonstrated that success isn’t about luck—it’s about preparation meeting opportunity.

What makes Ajay Piramal truly remarkable isn’t just his wealth or business acumen. It’s his ability to reinvent himself and his businesses repeatedly, his commitment to ethical practices, and his vision of creating enterprises that outlive him.

Frequently Asked Questions

1. What is Ajay Piramal’s current net worth?

As of 2024, Ajay Piramal’s net worth is estimated at approximately $4.2 billion. However, net worth figures fluctuate based on market conditions, business valuations, and investment performance. His wealth comes primarily from his holdings in Piramal Enterprises and various other investments across pharmaceuticals, financial services, and real estate.

2. How did Ajay Piramal make his fortune?

Ajay Piramal built his fortune through strategic diversification and smart acquisitions. He started by transforming his family’s textile business, then pivoted to pharmaceuticals through aggressive acquisition of brands. The watershed moment came in 2010 when he sold his domestic formulations business to Abbott for $3.72 billion, which he then used to expand into financial services, healthcare information management, and other high-growth sectors.

3. What companies does the Piramal Group own?

The Piramal Group operates across multiple sectors through various entities including Piramal Pharma (pharmaceuticals and healthcare), Piramal Capital & Housing Finance (financial services), Piramal Realty (real estate), and Piramal Foundation (social initiatives). The group also has investments in healthcare information management and medical diagnostics.

4. Is Ajay Piramal related to the Ambani family?

Yes, through marriage. Ajay Piramal’s son, Anand Piramal, is married to Isha Ambani, daughter of Mukesh Ambani, Chairman of Reliance Industries. The wedding in 2018 was one of the most high-profile business family unions in India, bringing together two of the country’s most influential business families.

5. What is Ajay Piramal’s educational background?

Ajay Piramal holds a Bachelor’s degree in Science from Bombay University and a Master’s in Management Studies from the Jamnalal Bajaj Institute of Management Studies. His formal education in management has been instrumental in his strategic approach to building and scaling businesses across diverse sectors.

Vijay Kedia Net Worth 2025: Shocking Secrets Behind His Massive Wealth

Renee Brand Owner: The Inspiring Journey Behind India’s Beauty Revolution

From TV Star to Beauty Boss: Aashka Goradia’s RENÉE Success Story